Introduction

For companies and investment funds holding a stock portfolio of more than 100 million dollars in value, the US stock exchange commission (SEC) requires a Form 13F filing. This document is filed each quarter and lists the stock holdings of the company for the last quarter. It is usually filed up to 45 days after the deadline of the reporting period with the SEC and is freely available from their databases.

E.g. https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001061768&owner=include&count=40

There are a few webpages who list the information of these filings (e.g. https://fintel.io or https://formthirteen.com/) but I thought it would be fun to create an own analysis tool that downloads and parses these filings and generates easy to read plots that show the quarterly changes in stock holdings.

Please evaluate the risks responsibly when investing in stocks as it should not be a form of gambling. Especially in 2020, where the markets have become unpredictably volatile.

Example Usage

This tool downloads SEC Form 13F filings for a company/fund from the SEC Edgar database in order to analyze changes in the stock portfolio.

To initialize:

- Import the class definition files.

- Look up the company identifier (CIK number).

- Specify the company name.

- Create a Portfolio object.

from Portfolio13FHR import Portfolio

CIK = '0001061768'

Name = 'Baupost Group LLC/MA'

portfolio = Portfolio(CIK,Name)

Upon creation, all latest SEC Form 13F filings are downloaded automatically into a folder in XML format and the BeautifulSoup package is used to parse the relevant information from the documents into DataFrames.

In order to compare the portfolio difference of the two most recent filings use the following methods:

portfolio.compare_recent_changes()

portfolio.data_recent.head()

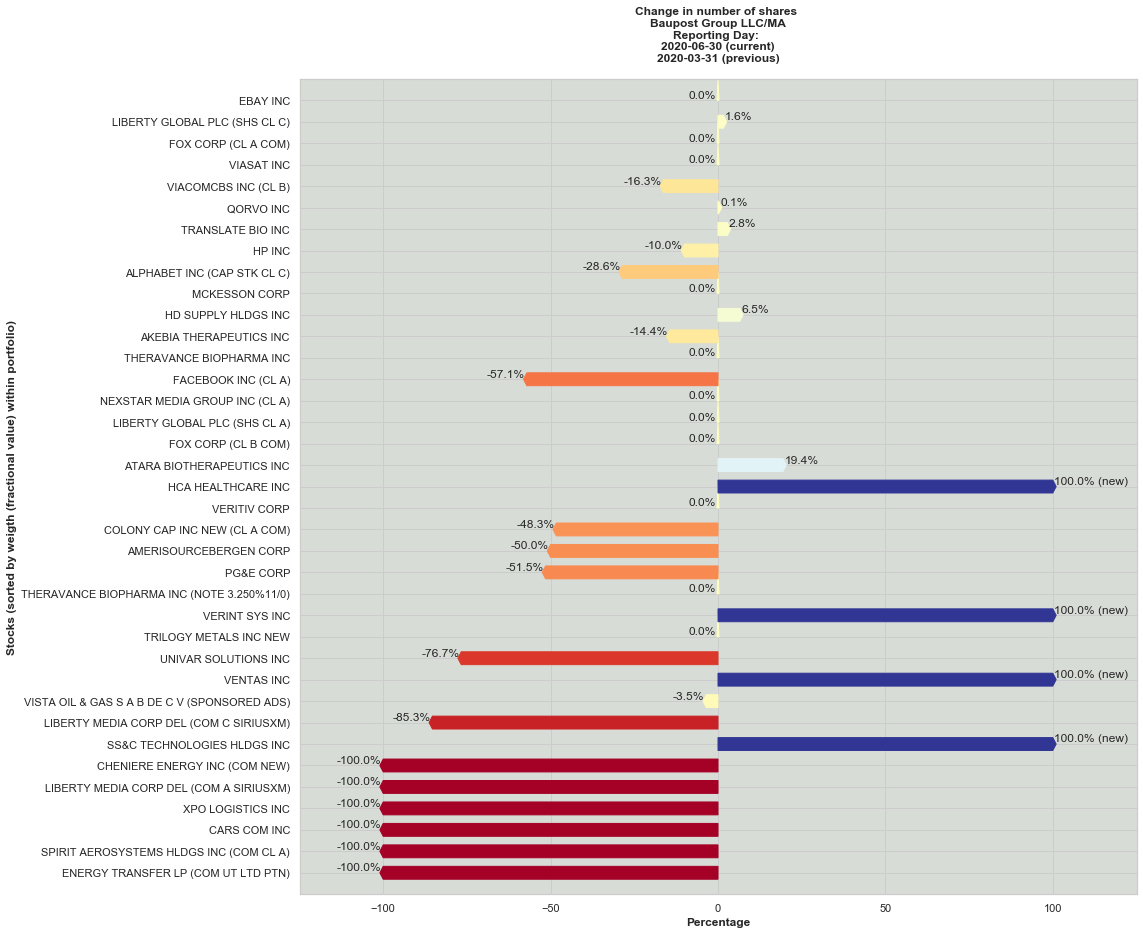

portfolio.plot_recent_shares_change(portfolio.data_recent)

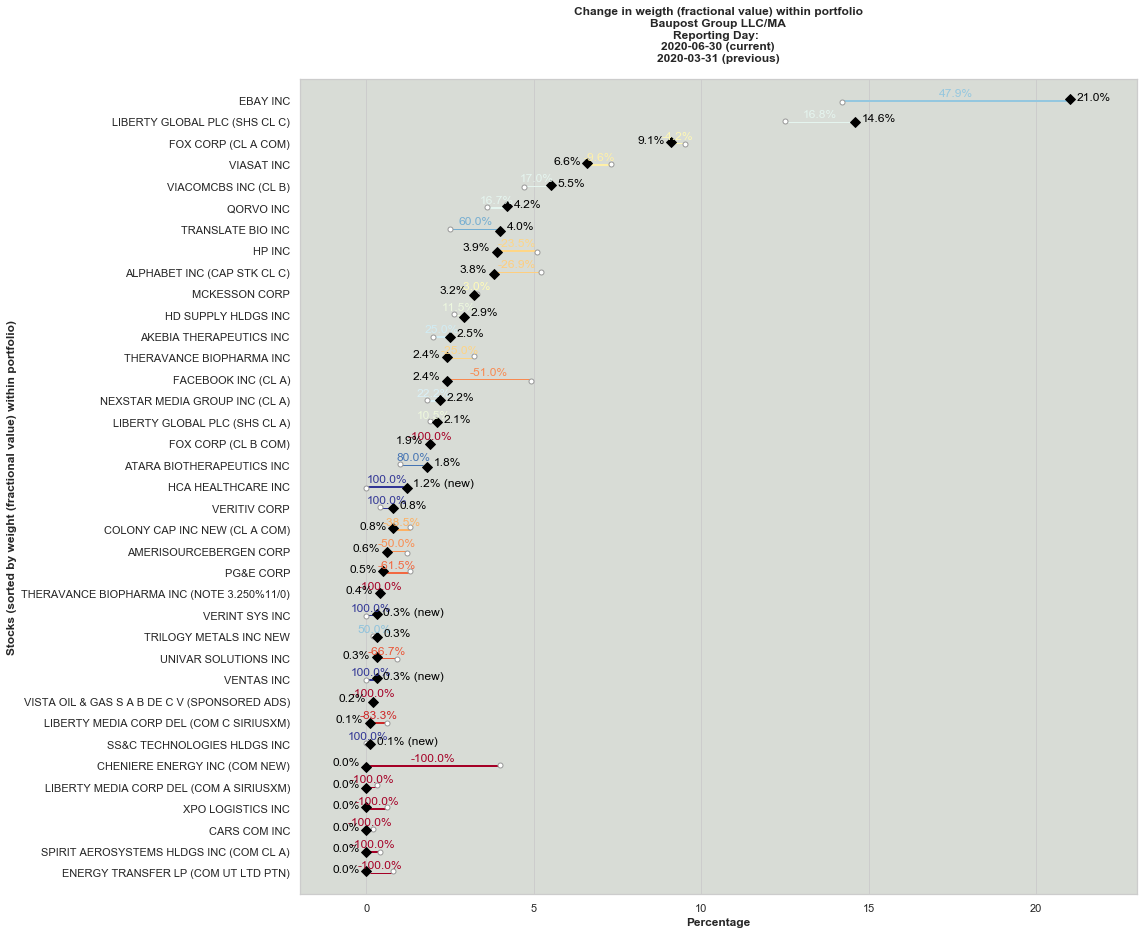

portfolio.plot_recent_value_change(portfolio.data_recent)

# Most recent additions

print("Recent portfolio additions: \n",portfolio.data_recent_additions[['value_current_perc','shares_change_perc']])

Recent portfolio additions:

value_current_perc shares_change_perc

LIBERTY GLOBAL PLC (SHS CL C) 14.6 1.6

QORVO INC 4.2 0.1

TRANSLATE BIO INC 4.0 2.8

HD SUPPLY HLDGS INC 2.9 6.5

ATARA BIOTHERAPEUTICS INC 1.8 19.4

HCA HEALTHCARE INC 1.2 100.0

VENTAS INC 0.3 100.0

VERINT SYS INC 0.3 100.0

SS&C TECHNOLOGIES HLDGS INC 0.1 100.0

The first plot shows an overview based on the changes in Number of shares for the portfolio:

The second plot shows the changes in weights of the total portfolio value in the most recent filing (Note that this plot includes both the share purchases or sellings as well as the changes of the share price):

If desired, analyze a specific stock further using the “analyze_stock()” method:

# Dictionary of name to stock symbol

symbols = {

'HCA HEALTHCARE INC': 'HCA'

}

OFFSET = 120 # Plot additional OFFSET days before start of reporting period

portfolio.analyze_stock('HCA HEALTHCARE INC', symbols['HCA HEALTHCARE INC'], PLOT_OFFSET=OFFSET)

The method downloads share price information using the YahooFinance API and creates a bokeh plot as html file with information on the minimum/maximum purchase price during the reporting period as well as the difference compared to the latest trading day:

Source Code

The complete code is available here: https://github.com/zpetan/sec-13f-portfolio-python

Code: Downloading and parsing from SEC Edgar Database

"""

Author: Pepe Tan

Date: 2020-10-06

MIT License

"""

import pandas as pd

from bs4 import BeautifulSoup

from ticker_class import Ticker

from datetime import datetime

class Filing13F:

"""

Class containing common stock portfolio information from an institutional investor.

1. Parsed from 13F-HR filing from SEC Edgar database.

"""

# If True prints out results in console

debug = False

def __init__(self,filepath=''):

""" Initialize object """

self.filepath = filepath # Path of file

# Directly call parse_file() when filepath is provided with __init__

if self.filepath:

self.parse_file(self.filepath)

def parse_file(self, filepath=''):

""" Parses relevant information from 13F-HR text file """

self.filepath = filepath # Path of file

if self.debug:

print(self.filepath)

# Opens document and passes to BeautifulSoup object.

doc = open(filepath)

soup = BeautifulSoup(doc, 'html.parser') # OBS! XML parser will not work with SEC txt format

# Print document structure and tags in console

if self.debug:

print(soup.prettify())

for tag in soup.find_all(True):

print(tag.name)

## --- Parse content using tag strings from txt document: <tag> content </tag>

# OBS html.parser uses tags in lowercase

# Name of filing company

self.company = soup.find('filingmanager').find('name').string

# Company identifier: Central Index Key

self.CIK = soup.find('cik').string

# Form type: 13F-HR

self.formtype = soup.find('type').string

# 13F-HR file number

self.fileNumber = soup.find('form13ffilenumber').string

# Reporting date (e.g. 03-31-2020)

self.period_of_report_date = datetime.strptime(soup.find('periodofreport').string, '%m-%d-%Y').date()

# Filing date (up to 45 days after reporting date)

self.filing_date = datetime.strptime(soup.find('signaturedate').string, '%m-%d-%Y').date()

## --- Parse stock list: Each stock is marked with an infoTable parent tag

stocklist = soup.find_all('infotable') # List of parent tag objects

# Initialize lists

name = [] # Company name

cusip = [] # CUSIP identifier

value = [] # Total value of holdings

amount = [] # Amount of stocks

price_per_share = [] # Share price on reporting day != purchase price

poc = [] # Put/Call options

symbol = [] # Trading symbol

# Fill lists with each stock

for s in stocklist:

# Company name & Title of class (e.g. COM, Class A, etc)

n = s.find("nameofissuer").string

n = n.replace('.','') # Remove dots

c = s.find("titleofclass").string

if c != "COM":

name.append(n+" ("+c+")")

else:

name.append(n)

# CUSIP identifier

cusip.append(s.find("cusip").string)

# Total value of holdings

v = int(s.find("value").string)

value.append(v)

# Amount of stocks

ssh = int(s.find("shrsorprnamt").find("sshprnamt").string)

amount.append(ssh)

# Share price on reporting day (OBS! != purchase price)

price_per_share.append(round(v*1000/ssh,2))

# Put/Call options

put_or_call = s.find("putcall")

if put_or_call:

poc.append(put_or_call.string)

else:

poc.append('No')

# Create dictionary

stock_dict = {"filed name":name, "cusip":cusip, "value":value, "amount":amount,

"price_per_share":price_per_share, "put_or_call":poc}

# Store in dataframe

data = pd.DataFrame(stock_dict)

# Drop rows with put/call option

indexes = data[ data['put_or_call'] != 'No' ].index

data.drop(indexes, inplace=True)

# data.set_index('symbol', inplace=True)

data.set_index('filed name', inplace=True)

self.data = data

return

Code: Analyzing recent changes in Stock Portfolio

"""

Author: Pepe Tan

Date: 2020-10-06

MIT License

"""

import os

import numpy as np

import pandas as pd

from Filing13FHR import Filing13F

from secedgar.filings import Filing, FilingType

import matplotlib.pyplot as plt

import matplotlib.colors as colors

import matplotlib.cm as cmx

import seaborn as sns

import yfinance as yf

from bokeh.plotting import ColumnDataSource, figure, output_file, show, save

from bokeh.layouts import gridplot

from bokeh.models import HoverTool, BoxAnnotation, Span, Label, Arrow, NormalHead

from collections import OrderedDict

from datetime import date, timedelta

class Portfolio:

"""

Class containing common stock portfolio information from an institutional investor.

1. Retrieves quarterly SEC 13F-HR filings from SEC Edgar database.

2. Creates a 'self.data_recent' DataFrame which contains the absolute

and relative changes in amount of shares and portfolio weigth

(with respect to the reported total portfolio value) since the last filing.

3. Creates a 'self.data_recent_additions' DataFrame with the additions

in amount of shares since the last filing.

4. Visualizations using 'self.plot_recent_shares_change(df)'

and 'self.plot_recent_value_change(df)'.

5. Stock analysis: Recent trading day vs. reporting period

via Bokeh plot.

"""

# If True prints out results in console

debug = False

def __init__(self,CIK='',Name=''):

""" Sets up object """

self.CIK = CIK # Company identifier: Central Index Key

self.Name = Name # Company name

# Directly call functions when filename is provided upon __init__

if self.CIK:

self.retrieve_filings(self.CIK)

self.parse_all()

def retrieve_filings(self, CIK=''):

""" Download latest filings from SEC Edgar system into directory in pseudo html/xml .txt format """

self.CIK = CIK

self.filings = Filing(cik_lookup=self.CIK,

filing_type=FilingType.FILING_13F,

count=4) # Set count=4 for the last four filings

foldername = 'Edgar filings_XML'

self.filings.save(foldername)

self.directory = foldername + '/' + self.CIK + '/13f' # example: "Edgar filings_XML/CIK/13f"

return

def parse_all(self):

""" Creates parsed Filing13F instance for all text documents in directory """

self.docs = [d for d in os.listdir(self.directory) if d.endswith('.txt')] # List of document names

if self.debug:

print(self.docs)

self.parsed_filings = []

for doc in self.docs:

filepath = self.directory + '/' + doc

if self.debug:

print(filepath)

self.parsed_filings.append(Filing13F(filepath))

return

def compare_recent_changes(self):

""" Analysis of the two most recent filings """

# Retrieve filed report date

report_dates = []

filing_dates = []

for f in self.parsed_filings:

report_dates.append(f.period_of_report_date)

filing_dates.append(f.filing_date)

# Sort and retrieve two most recent portfolios

report_dates.sort(reverse=True) # Most recent first

filing_dates.sort(reverse=True) # Most recent first

self.current_report_date = report_dates[0]

self.previous_report_date = report_dates[1]

self.current_filing_date = filing_dates[0]

self.previous_filing_date = filing_dates[1]

for f in self.parsed_filings:

if f.period_of_report_date == self.current_report_date:

data_current = f.data

data_current['shares_current'] = data_current['amount']

data_current['value_current'] = data_current['value']

elif f.period_of_report_date == self.previous_report_date:

data_previous = f.data

data_previous['shares_previous'] = data_previous['amount']

data_previous['value_previous'] = data_previous['value']

dataDiff = pd.concat([data_previous['shares_previous'], data_current['shares_current'] ],

axis=1, join='outer')

dataDiff.fillna(value=0, inplace=True)

dataDiff['shares_change_abs'] = ( dataDiff['shares_current'] - dataDiff['shares_previous'] )

dataDiff['shares_change_perc'] = round(100*( dataDiff['shares_current'] - dataDiff['shares_previous'] ) / dataDiff['shares_previous'],1)

dataDiff['shares_change_perc'].replace(np.inf, 100, inplace=True)

dataDiff = pd.concat([ dataDiff, data_previous['value_previous'], data_current['value_current'] ], axis=1, join='outer')

dataDiff.fillna(value=0, inplace=True)

dataDiff['value_change_abs'] = ( dataDiff['value_current'] - dataDiff['value_previous'] )

dataDiff['value_previous_perc'] = round(100*( dataDiff['value_previous'] / dataDiff['value_previous'].sum()),1)

dataDiff['value_current_perc'] = round(100*( dataDiff['value_current'] / dataDiff['value_current'].sum()),1)

dataDiff['value_change_perc'] = dataDiff['value_current_perc'] - dataDiff['value_previous_perc']

dataDiff['value_change_perc_rel'] = round(100*(dataDiff['value_current_perc'] - dataDiff['value_previous_perc']) / dataDiff['value_previous_perc'],1)

dataDiff['value_change_perc_rel'].replace(np.inf, 100, inplace=True)

dataDiff['value_change_perc_rel'].replace(0, -100, inplace=True)

# Reorder stocks following largest current value in portfolio:

self.data_recent = dataDiff.sort_values(by='value_current_perc', ascending=False)

# Only additions

additions = dataDiff['shares_change_abs'] > 0

dataDiff_additions = dataDiff[additions]

# Reorder stocks following largest current value in portfolio:

self.data_recent = dataDiff.sort_values(by='value_current_perc', ascending=False)

self.data_recent_additions = dataDiff_additions.sort_values(by='value_current_perc', ascending=False)

return

def plot_recent_shares_change(self, data):

""" Analysis of the two most recent filings """

# Sort stocks by valuefrom highest to smallest in current portfolio

data = data.sort_values(by='value_current_perc')

Y_RANGE=range(0,len(data.index))

# Theme and colormap

sns.set(style="whitegrid")

colornorm = colors.Normalize(np.min(data['shares_change_perc'].values),

np.max(data['shares_change_perc'].values))

colormap = plt.cm.RdYlBu

scalarMap = cmx.ScalarMappable(norm=colornorm,cmap=colormap)

# Initialize plot

SIZE = 15

XLIM = 125

YLIM = -1

fig, ax = plt.subplots(figsize=(SIZE, SIZE))

ax.set_xlim(-XLIM,XLIM)

ax.set_ylim(YLIM,data.shape[0])

ax.set_yticks(Y_RANGE)

ax.set_yticklabels(data.index)

ax.set_facecolor('xkcd:light grey')

# Define plotted values

previous_shares = data['shares_previous'].values

arrow_starts = np.repeat(0,data.shape[0]) # Arrows start from zero

arrow_lengths = data['shares_change_perc'].values

# Add arrows and display values as text in plot

for i, stock in enumerate(data.index):

colorVal = scalarMap.to_rgba(arrow_lengths[i])

# Annotation

if arrow_lengths[i] > 0:

OFFSET_X = 0.5

OFFSET_Y = 0.1

if previous_shares[i] == 0:

ax.text(arrow_lengths[i]+OFFSET_X,

i+OFFSET_Y,

str(round(arrow_lengths[i],1)) + "% (new)",

ha="left")

else:

ax.text(arrow_lengths[i]+OFFSET_X,

i+OFFSET_Y,

str(round(arrow_lengths[i],1)) + "%",

ha="left")

elif arrow_lengths[i] <= 0:

OFFSET_X = -0.5

OFFSET_Y = 0.1

ax.text(arrow_lengths[i]+OFFSET_X,

i+OFFSET_Y,

str(round(arrow_lengths[i],1)) + "%",

ha="right")

# Arrow

ax.arrow(arrow_starts[i],

i,

arrow_lengths[i],

0,

head_width=0.6,

head_length=1,

width=0.6,

color=colorVal)

# Title and labels

ax.set_title("Change in number of shares \n"

+ self.Name + "\n"

+ "Reporting Day: \n"

+ str(self.current_report_date) +" (current)\n"

+ str(self.previous_report_date) +" (previous)\n", fontweight="bold")

ax.set_ylabel('Stocks (sorted by weigth (fractional value) within portfolio)',fontweight="bold")

ax.set_xlabel('Percentage',fontweight="bold")

return

def plot_recent_value_change(self, data):

""" Analysis of the two most recent filings """

# Sort stocks by valuefrom highest to smallest in current portfolio

data = data.sort_values(by='value_current_perc')

Y_RANGE=range(0,len(data.index))

# Theme and colormap

sns.set(style="whitegrid")

colornorm = colors.Normalize(np.min(data['value_change_perc_rel'].values), np.max(data['value_change_perc_rel'].values))

colormap = plt.cm.RdYlBu

scalarMap = cmx.ScalarMappable(norm=colornorm,cmap=colormap)

# Initialize plot

SIZE = 15

XLIM = 2

YLIM = -1

fig, ax = plt.subplots(figsize=(SIZE, SIZE))

ax.set_facecolor('xkcd:light grey')

# Define plotted values

arrow_starts = data['value_previous_perc'].values

arrow_lengths = data['value_change_perc'].values

arrow_lengths_rel = data['value_change_perc_rel'].values

arrow_ends = data['value_current_perc'].values

# Prepare lollipop plot

ax = sns.stripplot(data=data,

x='value_previous_perc',

y=data.index,

orient='h',

size=5,

color='white', linewidth=1)

ax = sns.stripplot(data=data,

x='value_current_perc',

y=data.index,

orient='h',

size=7,

color='black', linewidth=1, marker="D")

# Add arrows and display values as text in plot

for i, stock in enumerate(data.index):

colorVal = scalarMap.to_rgba(arrow_lengths_rel[i])

# Annotation

if arrow_lengths[i] > 0:

OFFSET_X_ARROW = -0.1

OFFSET_X = 0.2

OFFSET_Y = 0.2

ax.text((arrow_starts[i] + arrow_lengths[i]/2),

i + OFFSET_Y,

str(round(arrow_lengths_rel[i],1)) + "%",

ha="center",

color=colorVal)

if arrow_starts[i] == 0:

ax.text(arrow_ends[i] + OFFSET_X,

i,

str(round(arrow_ends[i],1)) + "% (new)",

ha="left",

color='black')

else:

ax.text(arrow_ends[i] + OFFSET_X,

i ,

str(round(arrow_ends[i],1)) + "%",

ha="left",

color='black')

elif arrow_lengths[i] <= 0:

OFFSET_X_ARROW = 0.1

OFFSET_X = -0.2

OFFSET_Y = 0.2

ax.text((arrow_starts[i] + arrow_lengths[i]/2),

i + OFFSET_Y,

str(round(arrow_lengths_rel[i],1)) + "%",

ha="center",

color=colorVal)

ax.text(arrow_ends[i] + OFFSET_X, i ,

str(round(arrow_ends[i],1)) + "%",

ha="right",

color='black')

# Arrow

ax.arrow(arrow_starts[i],

i,

arrow_lengths[i] + OFFSET_X_ARROW,

0,

head_width=0,

head_length=0,

width=0.02,

color=colorVal)

# Limits of axis

ax.set_xlim(-XLIM,

XLIM + np.max([arrow_starts,arrow_starts + arrow_lengths]))

ax.set_ylim(YLIM,data.shape[0])

ax.set_yticks(Y_RANGE)

ax.set_yticklabels(data.index)

# Title and labels

ax.set_title("Change in weigth (fractional value) within portfolio\n"

+ self.Name + "\n"

+ "Reporting Day: \n"

+ str(self.current_report_date) +" (current)\n"

+ str(self.previous_report_date) +" (previous)\n",fontweight="bold")

ax.set_ylabel('Stocks (sorted by weight (fractional value) within portfolio)',fontweight="bold")

ax.set_xlabel('Percentage',fontweight="bold")

return

def analyze_stock(self,stockname='',ticker='', PLOT_OFFSET = 0, IS_SHOW=True):

""" Analysis of stock price since last reporting and filing day """

# Retrieve stock data from Yahoo finance

stock = yf.Ticker(ticker)

hist = stock.history(period="max") # All historical data

# Define important dates (datetime)

REPORT_START = self.previous_report_date # Previous reporting day

REPORT_END = self.current_report_date # Current reporting day

REPORT_FILING = self.current_filing_date # Current filing day (ca. 60 days delay)

TODAY = date.today()

YESTERDAY = TODAY - timedelta(days = 1)

# Create dataframe from Reporting day - offset until most recent trading day

START = REPORT_START- timedelta(days = PLOT_OFFSET)

df=hist.loc[START:]

# Indices

inc = df.Close > df.Open

dec = df.Open > df.Close

# Convert DataFrame to ColumnDataSource

source = ColumnDataSource(ColumnDataSource.from_df(df))

source_dec = ColumnDataSource(ColumnDataSource.from_df(df[dec]))

source_inc = ColumnDataSource(ColumnDataSource.from_df(df[inc]))

# 1st Plot: Candlestick

# Plot parameters

WITDH = 1500

HEIGHTVOL = 300

BARWITDH = 16*60*60*1000

TOOLS = "pan,wheel_zoom,box_zoom,reset,save"

# Create plot

p = figure(x_axis_type="datetime", tools=TOOLS, plot_width=WITDH, title = stockname +' (' + ticker +'), ' +'Portfolio: ' + self.Name)

p.grid.grid_line_alpha=0.3

p.segment('Date', 'High', 'Date', 'Low', source=source, color="black", name="segment")

p.vbar('Date', BARWITDH, 'Open', 'Close', source=source_inc, fill_color="greenyellow", line_color="black")

p.vbar('Date', BARWITDH, 'Open', 'Close', source=source_dec, fill_color="#F2583E", line_color="black")

# Create tooltips

p.add_tools(HoverTool(

names=["segment"],

tooltips=OrderedDict([

("Date", "@Date{%F}"),

("Open", '$@{Open}{0.2f}'),

("Close", '$@{Close}{0.2f}' ),

("Volume", "@Volume{($ 0.00 a)}")]),

formatters={

'@Date': 'datetime'},

mode='vline'))

# Closing prices

PURCHASE_CLOSE_MIN = min(df.loc[REPORT_START:REPORT_END].Close)

PURCHASE_CLOSE_MAX = max(df.loc[REPORT_START:REPORT_END].Close)

#YESTERDAY_CLOSE = df.loc[YESTERDAY].Close

YESTERDAY_CLOSE = df.iloc[-1].Close

# Add annotations

p.add_layout(BoxAnnotation(

left=REPORT_START, right=REPORT_END,

fill_alpha=0.1, fill_color='green'))

p.add_layout(BoxAnnotation(

left=REPORT_END, right=REPORT_FILING,

fill_alpha=0.06, fill_color='blue'))

p.add_layout(Label(x=REPORT_START + (REPORT_END-REPORT_START)/3,

y=0, y_units='screen',

text='(---Reporting period---)'))

p.add_layout(Label(x=REPORT_END + (REPORT_FILING-REPORT_END)/4,

y=0, y_units='screen',

text='(---Until filing---)'))

p.add_layout(Label(x=REPORT_FILING + (TODAY-REPORT_FILING)/2,

y=0, y_units='screen',

text='(---After filing---)'))

p.add_layout(Span(

location=YESTERDAY_CLOSE,

dimension='width',

line_color='black',

line_dash='dotted',

line_width=0.5))

p.add_layout(Span(

location=PURCHASE_CLOSE_MIN,

dimension='width',

line_color='black',

line_dash='dotted',

line_width=0.5))

p.add_layout(Span(

location=PURCHASE_CLOSE_MAX,

dimension='width',

line_color='black',

line_dash='dotted',

line_width=0.5))

p.add_layout(Span(

location=YESTERDAY_CLOSE,

dimension='width',

line_color='black',

line_dash='dotted',

line_width=0.5))

p.add_layout(Label(

x=REPORT_START,

y=PURCHASE_CLOSE_MIN,

text=''+str(PURCHASE_CLOSE_MIN)+' (Min. purchase price)'))

p.add_layout(Label(

x=REPORT_START,

y=PURCHASE_CLOSE_MAX,

text=''+str(PURCHASE_CLOSE_MAX)+' (Max. purchase price)'))

p.add_layout(Label(

x=REPORT_START,

y=YESTERDAY_CLOSE,

text=''+str(YESTERDAY_CLOSE)+' (Current price)'))

p.add_layout(Arrow(

start=NormalHead(fill_color="black",size=10),

end=NormalHead(fill_color="black",size=10),

x_start=TODAY,

y_start=PURCHASE_CLOSE_MIN,

x_end=TODAY,

y_end=YESTERDAY_CLOSE))

p.add_layout(Label(

x=TODAY + timedelta(days = 1),

y=PURCHASE_CLOSE_MIN + abs(PURCHASE_CLOSE_MIN-YESTERDAY_CLOSE)/2,

text=str(round((100*(YESTERDAY_CLOSE-PURCHASE_CLOSE_MIN)/PURCHASE_CLOSE_MIN),1))+"%"))

# 2nd Plot: Volume

q = figure(plot_height=HEIGHTVOL,

plot_width = WITDH,

x_axis_type='datetime',

x_range=p.x_range,

title="Volume",

tools=TOOLS)

q.vbar('Date',

top = 'Volume',

source=source_inc,

width = BARWITDH,

fill_alpha = .5,

fill_color="greenyellow", line_color="black")

q.vbar('Date',

top = 'Volume',

source=source_dec,

width = BARWITDH,

fill_alpha = .5,

fill_color="#F2583E", line_color="black")

q.add_tools(HoverTool(

tooltips=OrderedDict([

("Date", "@Date{%F}"),

("Open", '$@{Open}{0.2f}'),

("Close", '$@{Close}{0.2f}' ),

("Volume", "@Volume{($ 0.00 a)}")]),

formatters={

'@Date': 'datetime'},

mode='vline'))

# Stock 1st and 2nd plot

plot = gridplot([[p], [q]])

# Save in directory

output_file(ticker+'_'+ str(REPORT_END)+'_'+ str(YESTERDAY)+'.html', title=stockname +' (' + ticker +')', mode='inline')

save(plot)

if IS_SHOW==True:

show(plot) # Open in browser

return